Table of Content

When you add in the fact that it’s cheaper than an apartment in many areas and you get to control the space, the advantages of buying a mobile home are always worth taking under consideration. Although the shape of the mobile home is often pre-determined, you have layout options from which to choose. Your manufacturer can give you an idea of what your choices are when you start looking at the available home designs.

Today’s manufactured homes bear little resemblance to the mobile homes of yesterday. The average size of a mobile home is about 20% smaller than what you’ll find with a stick-built structure. If you are a budget-conscious shopper who is looking at a single-wide trailer as an affordable living option, then you’ll have a long and narrow living footprint.

The Cons of Modular Housing

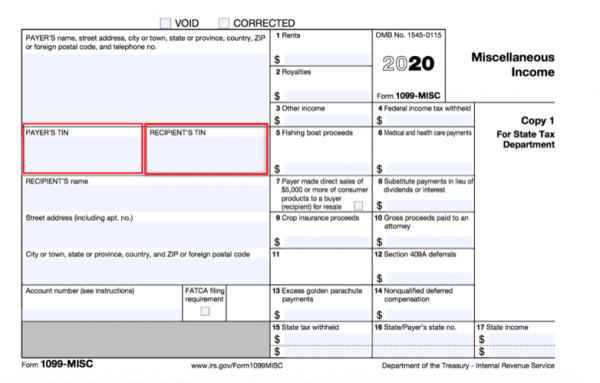

"Real property" is defined as land and anything attached to it permanently. Anything that can be removed without "injury" to the land is not real property. Personal property, on the other hand, is anything that is movable and not classified as real property. Even though mobile homes are not easily removed from land once placed, they are still considered personal property . On the other hand, stick-built homes are considered part of the real property. First, Fannie Mae and Freddie Mac both offer conventional financing for manufactured homes.

So, before you go out and buy a manufactured home, find out what year it was built. Most lenders tend to turn down loan applications from mobile homes manufactured before 1976. Single-wides are quite inexpensive and could be an excellent choice for secondary or vacation homes. A used single-wide mobile home would typically cost you between $10,000 and $25,000. Mobile homes are home to more than 17 million people in the United States, making them a popular housing option for many individuals.

The Cost of Living in Florida vs. Texas

Like a new car, once a mobile home leaves the factory, it quickly drops in value. Stick-built homes, on the other hand, normally appreciate in value over time because the stick-built home owner almost always owns the underlying land. While Rocket Mortgage doesn’t offer manufactured home financing, it might be the right choice for you if you decide to go the traditional housing route instead.

Usually, the bigger the home, the higher the budget for maintenance. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. By providing my email I agree to receive Forbes Advisor promotions, offers and additional Forbes Marketplace services. Please see our Privacy Policy for more information and details on how to opt out. If you buy a home from a private seller, you may also be able to work out a deal to finance directly with them.

Key Things to Know about Downsizing to a Manufactured or Mobile Home

Once you have the foundation in place for your manufactured home, a crane will lift it so that it settles into place. It doesn’t take long to hook up the utilities to the new structure, which means you can come home to your new place in no time at all. You can choose to live in a community that features manufactured housing or put the structure on property that you already own. Whatever the choice ends up being, you’ll discover that the ability to pursue the lifestyle you want quickly is worth the small investment you make for this housing option. Although modern manufacturing methods and design have altered the view of mobile homes, there is still a bias against them in some areas.

Most contractors can complete the work in under 75 days, with some areas seeing move-ins happening in 60 days or less. If you have a specific deadline to meet for some reason, you won’t find a faster option than this one to live in a house on a property that you own. In suburban and sparsely populated areas, there can be a shortage of available land with proper access and existing utility service. In some areas, the land is deed-restricted to require site-built construction. In rural areas, the cost of access and site preparation might make modular housing difficult or even cost-prohibitive.

If you’re still weighing your options between a manufactured home and a site-built home, keep reading to find out if manufactured housing is your best option. Homeownership is always considered a significant milestone for any American. As such, it’s no surprise why many people are seeking more affordable housing options.

Over 22 million people in the United States and countless more around the world are living in manufactured homes today. These properties account for 10% of the new single-family home starts that Americans create each year. Since the average cost-per-square-foot is less than 50% of what it is for a site-built house, the primary reason why families pursue this option is affordability. Sadly, construction sites are typically plagued by the problems of damage, theft, and delivery delays. With manufactured housing, these problems are minimal and resulting time and dollar savings are maximized.

There may be additional charges depending on the loan product or title services you select. Following is the estimated range of charges by Rocket Mortgage and Amrock for the settlement services they provide. These charges are customary and are provided so that you may compare them to other service provider charges.

The average mortgage in the United States is $1,030, whereas you can get into a double-wide for $350 and a monthly lot fee that’s less than that amount. The same financial factors that go into the decision for a mortgage will play a role in your personal property loan for a mobile home. You’ll need a solid credit score, a stable employment history, and a few years of tax records to prove that you have a reliable income. A down payment of any amount will help to reduce your interest rate, while your debt-to-income ratio can help a lender to determine what the best lending products are for your situation.

These are most likely chattel loans, and as with car loans you should shop around for a better rate if that’s the option you’re going with—but nothing beats dealer financing for convenience. Still, the fact that your home can be moved (as long as you haven’t permanently affixed it to a foundation) is an upside. If you need to relocate to a whole new area, you might not need to sell a house you enjoy living in and have customized to your needs. If you’re contemplating buying a house—or wondering if you will ever be able buy a house—chances are you’re aware that the U.S. housing market is currently in the midst of a wild ride. The pandemic sparked a global housing boom, driving home prices up an eye-popping 42%.

The experience is even better if the house is made up of separate modules, as they feature separate insulation to inhibit the transference of sound. However, moving home can only work if you have multiple installation sites. Moving a manufactured home would involve some legal and logistic complexities though.

Before planning to get your “sweet home”, be sure to evaluate your own specific housing goals and plan the right process for it. Some specific financing considerations surround manufactured homes. In some cases, they are considered personal property rather than real estate, and that can impact buyer plans and financing options. Single-wide mobile homes are the smallest of all manufactured housing options.They range in size from 600 to 1,330 square feet.

Due to their higher cost, triple-wides are not as popular as single and double-wides. This term, which crops up in real estate listings, describes property where people farm for fun rather than to make a living. With high mortgage interest rates and expensive home prices, many first-time homebuyers are comparing various mortgage options. Modular homes can last just as long as a standard home assuming they are well-made. Most modular homes are made of the same high-quality materials you'll find in new construction homes, so they can easily last for decades as long as they are well-maintained. Overall, it’s about what you want in a home and how you want to go about it.